Introduction Now in these days, financial transactions become more complicated, which is why there is a need to make them more flexible and easier. In these ways, the canclled cheque plays an important role in verifying bank account details for the purpose of activation of automatic debits from the customer account. Then, one common question […]

Category: NI Act

Why is a Cancelled Cheque Required for KYC?

Introduction A Cancelled Cheque plays a crucial role in the KYC process in the banking sector. Banking institutions must follow the KYC process to better understand their customers. In order to proceed with this process, it is necessary to provide proof of your identity and address. A cancelled cheque can be proof as it contains […]

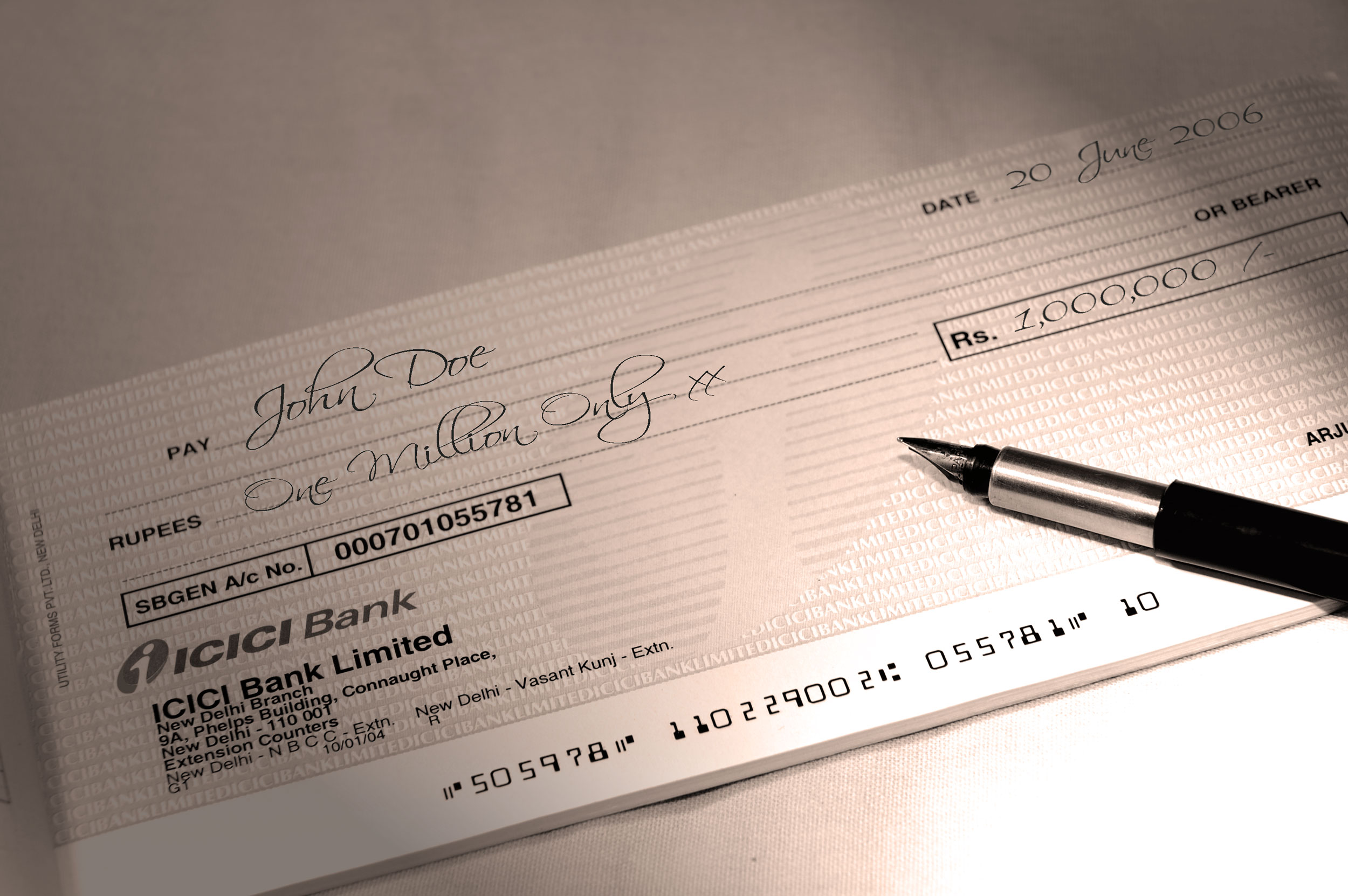

What Are The Main Essential Ingredients Of A Cheque?

Essential Ingredients of a Cheque Any bank account holder with a bank account in the particular bank is eligible to issue the cheque. Giving the cheque in favour of another person means he becomes a maker or drawer of the cheque. If a drawer desire, he may also write a cheque for self-withdrawal of money. […]

How to write a Cheque for self in India?

Introduction Writing a cheque for self withdrawal is an ancient and common method for withdrawing money from the self account from the bank. Nows in these days, after the revolution of the digital payment system, there are many options available for making payments and withdrawing funds from the own account in the bank. These days, […]

What happens if complainant died in the NI Act case?

Question – what happens when a complainant dies in the case of the negotiable Instrument Act? – The answer to the question is yes. As per the legal preposition, on the Death of the complainant in a summons case, the court can permit the legal representative to continue the complaint. That action of the court […]

What is a Cheque Bounce Notice under Section 138 of the NI Act?

Introduction Why do most people make their money transactions through the cheque method? Of course, it is a straightforward and secure method for all types of financial transactions. Whether the transaction is commercial or personal, it does not matter. But this method also has some positive and negative factors which we should know. What happens […]

Difference between Promissory note and Cheque under the NI Act

(1) introduction: Personal transactions or business transactions need payment. All people like to have a cash payment. But sometimes, cash payment carries risk. To secure payment, people seek negotiable instruments like cheques or promissory notes. But it is sorry to say that most of the time, people make the mistake of using a cheque or […]

If Death of complainant, can legal heir of deceased continue to proceed in the cheque bounce case U/s.138 of NI Act?

Whether demand notice can be faulted if any other sum indicated in addition to the said amount u/s.138 (b) of NI Act?

Question: Will demand notice be faulted if any other sum is indicated in addition to the said amount u/s.138 (b) of N.I. Act? The answer is no. According to the provision of The Negotiable Instrument Act,1881, Section 138 (B), the answer deals with the demand notice that the chequeholder gives. When we read Clause (b) […]

What is a gift cheque? if the cheque is given as a gift can it attract to cheque bounce case?

(1) What is a gift cheque? The gift cheque is another banking instrument used to gift money to loved ones, alternatively to hard cash. People use various types of cheques not only to make business or financial transactions easy and safe. In this global world, people may also like to use cheques for many other […]