Introduction

A Cancelled Cheque plays a crucial role in the KYC process in the banking sector. Banking institutions must follow the KYC process to better understand their customers. In order to proceed with this process, it is necessary to provide proof of your identity and address. A cancelled cheque can be proof as it contains your name, account number, and bank information. Please ensure that you have the required documentation available. Banks consider a cheque as a valid document to verify banking details. Having a cancelled cheque is crucial for KYC as it serves as proof of ownership. In this article, we will address the topic of the requirement of submitting a cancelled cheque for KYC purposes. Please read below for more information.

What is a Cheque?

Before we start the discussion of the requirement of a cancelled cheque for KYC purposes, first, we need to understand what a cheque is. Cheques are a simple and versatile payment method that can be used by individuals in both urban and rural areas.

A cheque is a lone kind of negotiable instrument that instructs a bank to transfer a specific amount of money from the person who wrote the cheque, known as the drawer, to the account of the person named on the cheque, known as the payee. The payee can be a designated person or the bearer of the cheque if no other payee is specified. Cheques are a negotiable instrument allowing easy and convenient funds transfer between different bank accounts. It is essential to ensure that the details on the cheque are accurate and up-to-date to avoid any complications or delays in the transaction. If the drawer writes a check to themselves, in that case, the drawer and payee are the same, it also known as a self-cheque, but there are some more parties involved in the cheque process that are given below;

Parties that are involved in the process of cheque

Drawer :

The drawer of a cheque is the person who writes and signs the cheque, ordering the bank to pay a specified amount.

Drawee:

The drawee is responsible for making payment on a cheque, according to financial institution guidelines.

Payee:

The recipient of funds sent by a bank is called the payee, whether an individual or an organization.

Two more parties may be involved.

Endorser:

A party that transfers the right to collect payment to another party is called an endorser.

Endorsee:

When a rights transfer is made, the person who receives those rights is known as the endorsee. The endorsee is granted the rights that are being transferred in their favor.

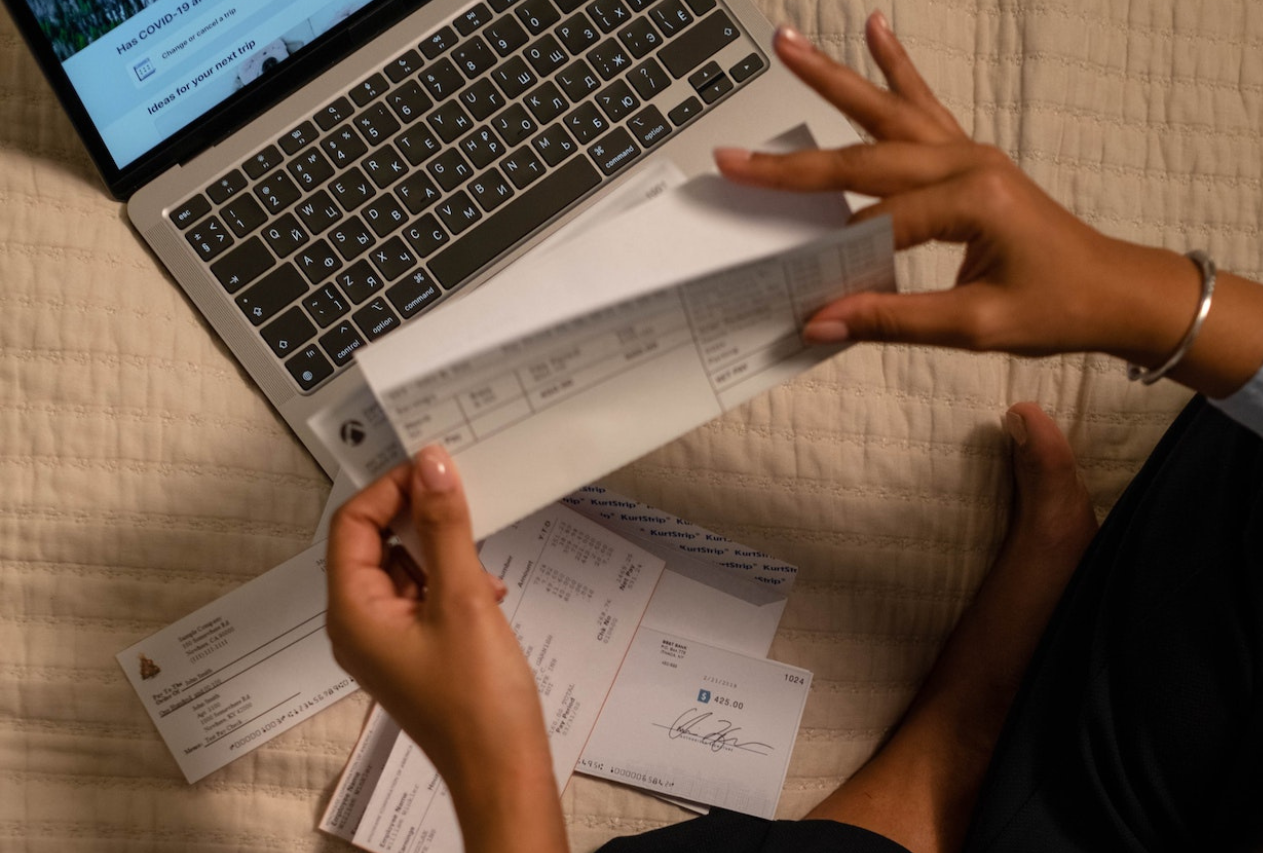

What is a cancelled cheque?

A cancelled cheque is marked with the word ‘cancelled’ written across the front. This marking indicates that the cheque cannot be cashed, but it still has value. When you provide a cancelled cheque, you share your bank’s name, account number, and unique cheque number. This is a safe way to share your banking information.

A cancelled cheque does not require a signature or notation. If a person possesses a cancelled cheque, it implies that they have a bank account. Cheques are commonly cancelled to avoid any potential fraudulent activity.

We should note that due to the cancelled cheque, it is impossible to withdraw money from a bank. However, it can be misused somewhere because some sensitive information is mentioned.

Why financial institutions and businesses require cancelled cheques for Know Your Customer (KYC)

KYC, which stands for Know Your Customer, is a crucial process in the banking industry. It allows banks to understand their customers better and enhance their customer service. KYC procedures implemented by banks ensure customer authenticity and monitor risks. These processes prevent money laundering, terrorism financing, and corruption. A cancelled cheque is a crucial document in the KYC process.

Can you do your KYC without a Cancelled cheque?

You may need to provide a cancelled check as part of the Know Your Customer (KYC) process. Financial firms use a cancelled cheque to verify clients’ banking details and authenticate their identity.

Cancelled Cheque for Electronic Clearing System (ECS)

The Electronic Clearing System (ECS) is an essential banking process that empowers us to quickly and securely make automatic payments and transfers. Automatic transactions are set up through the ECS process using your bank name, your name, and account number. Therefore, a cancelled cheque ensures the accuracy and safety of ECS transactions by providing information on where to take or send money.

Conclusion

Please be aware that a cancelled cheque cannot be used for transactions, but it does contain essential bank details that may be needed for other purposes. Providing accurate cheque details is essential for banks to identify their customers correctly. This information can be utilized to automate transactions, facilitate KYC processes, and perform other banking tasks. Effective management of cheques is crucial to prevent any fraudulent activities. Please ensure proper cheque handling to avoid any potential errors or fraudulent transactions.

Also Read:

What is a Cheque Bounce Notice under Section 138 of the NI Act?