Introduction

Now in these days, financial transactions become more complicated, which is why there is a need to make them more flexible and easier. In these ways, the canclled cheque plays an important role in verifying bank account details for the purpose of activation of automatic debits from the customer account. Then, one common question often comes to our mind is that: Does a cancelled cheque require a signature? In this article, we address a depth exploration of cancelled cheques, their various purposes, the relevance of signatures on cancelled cheques, and the requirements of cancelled cheques in the financial world. So please stay tuned and read more below;

Understanding Cancelled Cheques:

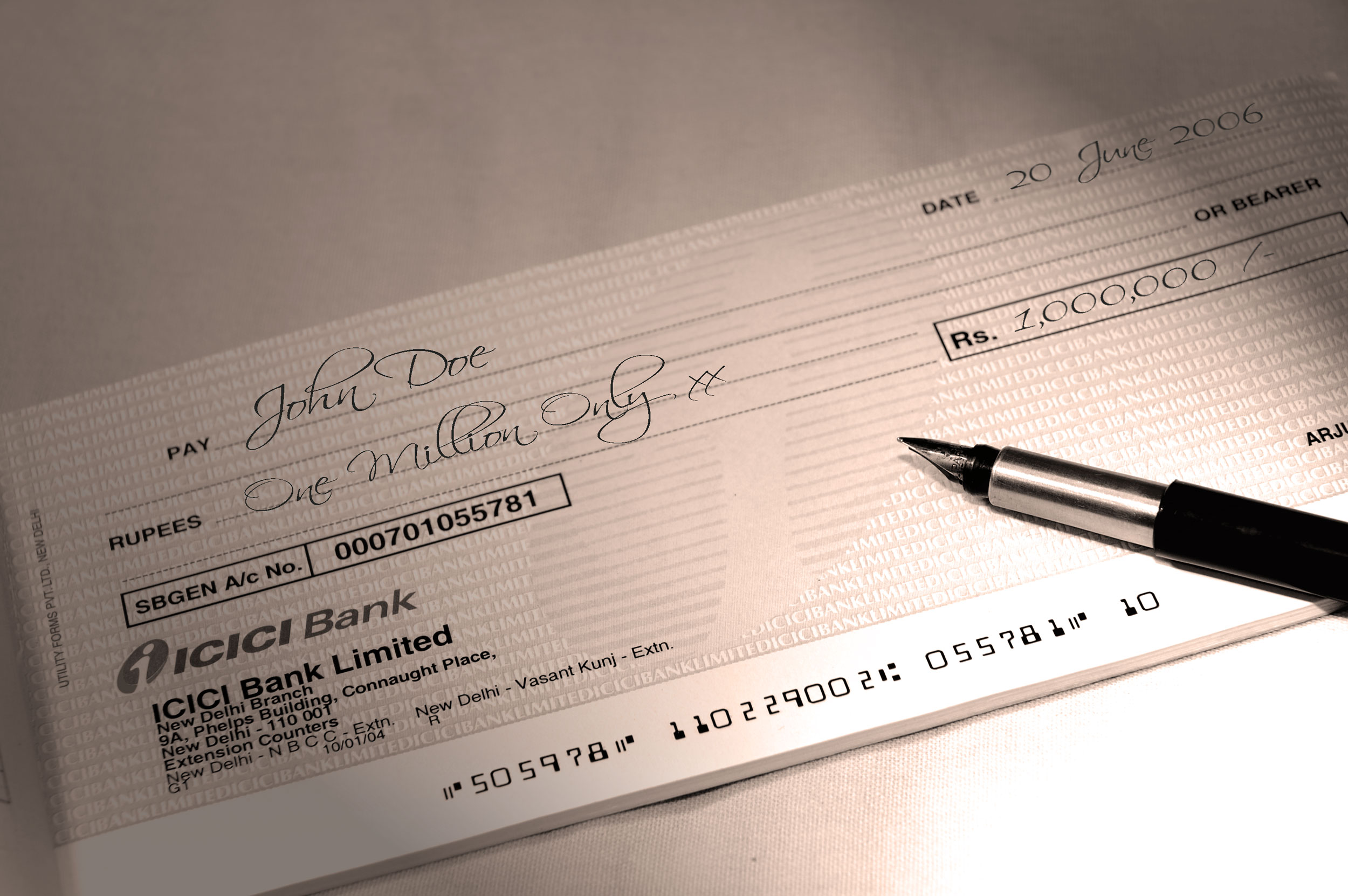

Before we enter into the question of does the signature is required in the cancelled cheque, let’s understand the foundational understanding of what a cancelled cheque is, in a core sense a cancelled cheque has no validity in financial transactions, it is totally ineffective for that. on the front of a cheque writing the word ‘ CANCELLED’ on the front of the cheque or punching whole in it makes invalidate. The main thing to note is that a cancelled cheque does not operate for making a payment purpose, instead, it is used for certain details of proof of account.

The Role of Cancelled cheques:

There are different role that a canceled cheque play in the financial world in different sectors. Some of the significant roles are given below;

Verification of Bank Account Details:

The basic usage of a canceled cheque lies in the verification of information about the bank account. It is required when an individual or business organization sets up any electronic transactions like salary deposits and automatic bill payments. A canclelled cheque is mostly required to ensure the accuracy of the bank account detail which is provided to the bank. Through this verification, the bank can avoid mistakes in electronic fund transfers.

Mandate for Automatic Debits:

The method of automatic debit is commonly used in various financial obligations, for example, it is used for loan payments, online payments, subscription services, etc. In that case, a cancelled cheque plays a crucial role and serves as tangible authorization for automated transactions without making funds deduction error and also save time.

KYC (Know Your Customer) Compliance:

Cancelled cheques play a crucial role to integral to the KYC process which is used by financial institutions for the verifying of the authenticity of account details. Know Your Customer compliance process is a crucial part of the purpose of security and transparency of financial transactions.

The Need for Signatures on Cancelled Cheques:

The main question that comes out is that dose the signature on a cancelled cheque is necessary or not. This may depend upon the purpose of the cancelled cheque required.

Verification of Signature:

In some cases, the signature of the account holder on a cancelled cheque is mandatory. That may be used for additional verification to ensure that the transaction is valid, legal, and true. Here, the purpose of a signature on a cancelled cheque is that make the authentication of a document valid and true.

Bank Policies:

Some banks’ policies insist that the signature on a cancelled cheque is required. It may vary in different banks according to their guidelines. There it is a good idea for an individual to verify the rules and regulations of their bank regarding the signing of a cancelled cheque.

Legal Considerations:

Certain legal necessities govern financial transactions in different places and jurisdictions. Some laws may mandate a signature on specific types of financial documentation, including a cancelled cheque.

Reasons for Requesting Cancelled Cheques

| Purpose | Explanation |

| Verification of Bank Account Details | To ensure accuracy while setting up electronic transactions |

| Mandate for Automatic Debits | For the authorizes when making an activation of automatic debits from the customer’s bank account. |

| KYC Compliance | As a part of the Know Your Customer(KYC) compliance process, it is used the verify the authenticity of the account holder. |

FAQ:

Q1: Is a signature always required on a canceled cheque?

A1: No. There is no universal requirement for the presence of a signature on a canceled cheque. That may depend on the certain purpose of a canceled cheque, and the policies of the bank. Some banks use it to ensure that the legal transaction is valid and true, that is the reason they require a signature on a cancelled cheque for additional verification of an account holder.

Q2: What legal requirement needs to know when dealing with cancelled cheques?

A2: A Legal requirement will change or be different according to the area of jurisdictions. That may be varied in specific regions for the legal terms governing the financial transaction. In some cases, it happens that by the law it is mandating a cancelled cheque with a signature for the compliance of financial documents. Being an account holder you need to ensure nuances that can help you to avoid legal difficulties with the bank.

Q3: Why do banks have different policies regarding signatures on cancelled cheques?

A3: There are many factors on that based banks formulate their policies, for example, internal banking process, securities measures, fulfilling a legality of government guiltiness, completing legal and mandate requirements, etc. This variation in the policies specifies certain types of financial transactions and also maintains regulatory guidelines which makes more flexibility in the banking framework.

Q4: Can I use a cancelled cheque as proof of payment?

A4: No, because there is no legal value of a cancelled cheque for making a financial transaction. It can be used for basic purposes such as providing proof of bank account details, as well as some authorization for particular financial transactions. It means a cancelled cheque can not be used as proof of payment like receipts or transaction statements.

Q5: How can individuals ensure compliance with their bank’s policies regarding cancelled cheques?

A5: An individual has to know about the bank’s policies it is important to avoid any future disputes with the bank’s work method. This type of information is easily available from various sources like, an individual directly collecting from the bank’s official customer care department, or it can be collected bank’s website, etc. An individual can find out this information related to the cancelled cheque and can ensure compliance.

Conclusion:

The requirement of a signature on a cancelled cheque depends on its purpose and the bank’s policies. Generally, a request for a cancelled cheque is provided by the bank when it is necessarily required from the customer. In most scenarios, a signature will required to fulfill legal and different verification purposes. However, it is also true, that it is not a thumb rule or universal mandate of form of authentication.

A cancelled cheque is used for different purposes such as the verification of bank account details, activation of automatic debits, compliance with the KYC process, etc.

From time to time financial institutions change their regulatory frameworks, and they inform their customers. They will request their customers to comply with certain requirements to fulfill a legal considerations to ensure secure financial transactions. In this way, the requirement of a cancelled cheque is a part of their verification and authentication of financial transactions, and in some scenarios, it may require a signature on a cancelled cheque for compliance with more security purposes.

Also Read:

What is the effect if Drawer’s Signature differs can it attract to cheque bounce case?

If Drawer’s Signature differs can it attract criminal proceedings u/s.138 of IN Act?